DONEGAL GROUP INC.UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Donegal Group Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

WE WILL HOLD ON APRIL 19, 2001

18, 2013

To the Stockholders of

DONEGAL GROUP INC.:

The

We will hold our 2013 annual meeting of stockholders of Donegal Group Inc. will be held at 10:00 a.m., local time, on Thursday, April 19, 2001,18, 2013, at the Company's offices, 1195 RiverHeritage Hotel Lancaster, 500 Centerville Road, Marietta,Lancaster, Pennsylvania 17547.17601. At theour 2013 annual meeting theof stockholders, our stockholders will act on the following matters:

1. Electionitems of stockholder business:

The election of the three nominees for Class C directors to serve until the expirationwe name in our accompanying proxy statement, each for a term of their three-year termsthree years and until their respective successors are elected;

2. Approvaltake office;

The approval of a proposalan amendment to (a) amend Article 4our certificate of incorporation to increase the Company's

Certificatenumber of Incorporation (the "Amendment") to (i) authorize

30,000,000 shares of a new class of common stock with one-tenth of a

vote per share designated asour Class A common stock (ii) reclassifywe have the Company's existing common stockauthority to issue from 30.0 million shares to 40.0 million shares;

The approval of our 2013 equity incentive plan for employees so that we will have sufficient shares available under our equity incentive plans to continue this incentive compensation plan for our employees;

The approval of our 2013 equity incentive plan for directors so that we will have sufficient shares available under our equity incentive plans to continue this incentive compensation plan for our directors; and

The ratification of our audit committee’s appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013.

The advance notice by-laws we have had in effect for many years require that our stockholders submit to us before a specific date detailed information regarding any stockholder nomination of a candidate for election as a director or any other item of stockholder business a stockholder wishes to propose for consideration by our stockholders at our annual meetings of stockholders. That date has expired with respect to our 2013 annual meeting of stockholders. Therefore, under applicable law and our by-laws:

no stockholder may validly present a nomination of a candidate for election as a Class C director other than the nominees we name for election as Class B common stock, effectC directors in our accompanying proxy statement or propose any other item of stockholder business at our 2013 annual meeting of stockholders other than those items of stockholder business we describe above and in our accompanying proxy statement; and

we will not conduct a one-for-three reverse splitvote of our stockholders on any item of stockholder business at our 2013 annual meeting of stockholders other than those items of stockholder business we describe above and in our accompanying proxy statement.

Our board of directors has established the close of business on March 1, 2013 as the record date for the determination of the Class B common stock and reduce the

numberholders of authorized shares thereof from 20,000,000 shares to

10,000,000 shares, (iii) eliminate the Company's existing Class A

common stock, (iv) establish the rights, powers and terms of theour Class A common stock and for the determination of the holders of our Class B common stock and (v) retain the authorityentitled to issue 2,000,000 sharesnotice of, series preferred stock, and (b) restate

Article 4 of the Certificate of Incorporation as so amended;

3. Approval of the Company's 2001 Equity Incentive Plan for Employees;

4. Approval of the Company's 2001 Equity Incentive Plan for Directors;

5. Approval of the Company's 2001 Employee Stock Purchase Plan;

6. Election of KPMG LLP as independent public accountants for the Company

for 2001; and

7. Any other matters that properly come before the meeting.

All stockholders of record as of the close of business on February 21, 2001

are entitled to vote at, theour 2013 annual meeting.

The Company's 2000 Annual Report, which is not partmeeting of thestockholders.

We include our 2012 annual report to stockholders and our proxy soliciting

material, is enclosed.

It is important that your shares be represented and voted at thestatement relating to our 2013 annual meeting. Please complete,meeting of stockholders with this notice of our 2013 annual meeting of stockholders. We also enclose a proxy card for you to sign, date and return in the enclosedpostage-prepaid envelope we also enclose.

Please return your completed and duly signed proxy card, in the

envelope provided whether or not you expect to attend theour 2013 annual meeting of stockholders in person.

By Orderperson, by mail, or vote by telephone or via the internet as we describe on the accompanying proxy card.

| By order of our board of directors, |

|

| Donald H. Nikolaus, |

| Chairman and Chief Executive Officer |

March 18, 2013

Marietta, Pennsylvania

Important Notice Regarding the Availability of the BoardProxy Materials for Our Annual Meeting of Directors,

Donald H. Nikolaus,

President and Chief Executive Officer

March 23, 2001

Marietta, Pennsylvania

TABLE OF CONTENTS

Page

----

ABOUT THE ANNUAL MEETING...................................................1

What is the purposeStockholders We Will Hold on April 18, 2013

We enclose a printed copy of the proxy statement for our 2013 annual meeting?.................................1

Who is entitledmeeting of stockholders and our 2012 annual report to votestockholders with this notice of annual meeting. You may also view each of these documents on the internet atwww.proxyvote.com. No information on the meeting?....................................1

What arewebsite other than the voting rightsproxy statement for our 2013 annual meeting of the stockholders?............................2

Who can attend thestockholders and our 2012 annual meeting?.........................................3

Whatreport to stockholders constitutes a quorum?.................................................3

How do I vote?.............................................................3

Can I change my vote after I return mypart of our proxy card?.........................3

How do I vote my 401(k) plan shares?.......................................4

What are the Board's recommendations?......................................4

What vote is requiredsolicitation materials for our 2013 annual meeting of stockholders or part of our 2012 annual report to approve each item?................................4

Who will pay the costs of soliciting proxies on behalf of the

Board of Directors?.....................................................5

STOCK OWNERSHIP............................................................5

Who are the largest owners of the Company's stock?.........................5

How much stock do the Company's directors and executive officers own?......6

Section 16(a) beneficial ownership reporting compliance....................8

Relationship with the Mutual Company.......................................8

ITEM 1 - ELECTION OF DIRECTORS............................................12

Directors Standing for Election...........................................12

Directors Continuing in Office............................................12

The Board of Directors and Its Committees.................................14

Compensation of Directors.................................................14

Executive Compensation....................................................15

Summary Compensation Table................................................15

Options Exercised and Values for Fiscal Year 2000.........................16

Report of the Compensation Committee......................................16

Comparison of Total Return on the Company's Common Stock

with Certain Averages..................................................19

Report of the Audit Committee.............................................20

Certain Transactions......................................................21

ITEM 2 - PROPOSAL TO AMEND THE CERTIFICATE OF INCORPORATION...............21

Description of the Amendment and the Stock Dividend.......................21

Background of the Amendment and the Stock Dividend........................23

Reasons for the Amendment and the Stock Dividend; Recommendation of the

Board of Directors.....................................................24

Certain Potential Disadvantages of the Amendment and the Stock Dividend...26

Federal Income Tax Consequences...........................................27

Description of the Class A Common Stock and the Class B Common Stock......28

Stockholder Information...................................................32

Certain Effects of the Amendment and the Stock Dividend...................32

i

ITEM 3 - APPROVAL OF THE 2001 EQUITY INCENTIVE PLAN FOR EMPLOYEES.........35

Description of the 2001 Equity Incentive Plan.............................35

Incentive Options and Non-Qualified Options...............................36

Amendment and Termination.................................................37

Federal Income Tax Consequences...........................................38

ITEM 4 - APPROVAL OF THE 2001 EQUITY INCENTIVE PLAN FOR DIRECTORS.........40

Description of the 2001 Director Plan.....................................40

Restricted Stock Awards...................................................42

Non-Qualified Stock Options...............................................42

Amendment and Termination.................................................43

Federal Income Tax Consequences...........................................43

ITEM 5 - APPROVAL OF THE 2001 EMPLOYEE STOCK PURCHASE PLAN................44

Description of the 2001 Employee Stock Purchase Plan......................44

Amendment and Termination.................................................47

Federal Income Tax Consequences...........................................47

ITEM 6 - ELECTION OF INDEPENDENT PUBLIC ACCOUNTANTS.......................48

STOCKHOLDER PROPOSALS.....................................................49

OTHER MATTERS.............................................................50

ii

DONEGAL GROUP INC.

PROXY STATEMENT

This proxy statement contains information relating to theour 2013 annual meeting of stockholders. We will hold our 2013 annual meeting of stockholders of Donegal Group Inc. to be held on Thursday, April 19, 2001,

beginning18, 2013, at 10:00 a.m., local time, at the offices of the Company, 1195 RiverHeritage Hotel Lancaster, 500 Centerville Road, Marietta,Lancaster, Pennsylvania 17547, and at any postponement, adjournment or

continuation of the meeting. This proxy statement and accompanying proxy are

first being17601.

On March 18, 2013, we mailed to stockholders on March 23, 2001.

ABOUT THE ANNUAL MEETING

WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

At the Company's annual meeting, stockholders will act upon the matters

outlined in the notice of meeting on the cover page of this proxy statement,

including

o the election of directors,

o the approval of an amendment of the Company's Certificate of

Incorporation,

o the approval of the 2001 Equity Incentive Plan for Employees,

o the approval of the 2001 Equity Incentive Plan for Directors,

o the approval of the 2001 Employee Stock Purchase Plan, and

o the election of the Company's independent public accountants.

In addition, the Company's management will report on the performance of the

Company during 2000 and respond to questions from stockholders.

WHO IS ENTITLED TO VOTE AT THE MEETING?

Onlyour stockholders of record at the close of business on March 1, 2013 this proxy statement, an accompanying form of proxy card and our 2012 annual report to stockholders. The mailing also included a postage-prepaid envelope for your convenience in returning your proxy card to us, unless you prefer to vote in person, by telephone or via the record date,

February 21, 2001, are entitledinternet. We ask stockholders to receive noticereturn their proxy cards to us whether or not they expect to attend our 2013 annual meeting of stockholders in person.

We will bear all of the costs of preparing and mailing our proxy materials to our stockholders for our 2013 annual meeting of stockholders and making those materials available for our stockholders to view on the internet. We will, upon request, reimburse brokers, nominees, fiduciaries, custodians and other record holders for their reasonable expenses in forwarding our proxy materials for our 2013 annual meeting of stockholders to the beneficial owners of our Class A common stock and to vote the sharesbeneficial owners of our Class B common stock that they held on that date atfor whom such persons serve as record holders.

We use the meeting,following defined terms relating to us, our subsidiaries and our affiliates in this proxy statement:

“Atlantic States” means Atlantic States Insurance Company;

“DFSC” means Donegal Financial Services Corporation;

“DGI,” “we,” “us” or any postponement, adjournment or continuation of the meeting.

1

WHAT ARE THE VOTING RIGHTS OF THE STOCKHOLDERS?

Each outstanding share of common stock will be entitled to one vote on each

matter to be voted upon at the meeting.

2

As of the record date,“our” mean Donegal Group Inc.;

“Donegal Mutual” means Donegal Mutual Insurance Company;

“Le Mars” means Le Mars Insurance Company;

“MICO” means Michigan Insurance Company;

“Peninsula” means the Peninsula Insurance Group;

“Sheboygan” means Sheboygan Falls Insurance Company;

“Southern” means Southern Insurance Company (the "Mutual

Company") owned 5,511,127of Virginia; and

“UCB” means Union Community Bank FSB.

(i)

(ii)

| Page | ||||

| 27 | ||||

Our Compensation Philosophy and Risk Management Considerations | 29 | |||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

Report of the Compensation Committees of Donegal Mutual and DGI | 36 | |||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

The Role of the Nominating Committee of Our Board of Directors | 38 | |||

| 39 | ||||

| 39 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

Description of Our Class A Common Stock and Our Class B Common Stock | 44 | |||

PROPOSAL 3 – APPROVAL OF OUR 2013 EQUITY INCENTIVE PLAN FOR EMPLOYEES | 46 | |||

| 46 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

(iii)

Unless we otherwise expressly indicate, all of the Company's outstanding common stock,information we include or approximately 62.2%incorporate by reference in this proxy statement for our 2013 annual meeting of stockholders relates to our 2012 fiscal year. Our 2012 fiscal year began on January 1, 2012 and ended on December 31, 2012.

(iv)

OUR 2013 ANNUAL MEETING OF STOCKHOLDERS

In accordance with this proxy statement, our board of directors solicits proxies from our stockholders for use in connection with our 2013 annual meeting of stockholders and any adjournment or postponement of our 2013 annual meeting of stockholders. We will hold our 2013 annual meeting of stockholders at 10:00 a.m., local time, on April 18, 2013 at the Company's outstanding common stock. The Mutual

Company has advisedHeritage Hotel Lancaster, 500 Centerville Road, Lancaster, Pennsylvania 17601.

What is the Company thatagenda for our 2013 annual meeting of stockholders?

At our 2013 annual meeting of stockholders, our stockholders will act upon the Mutual Company will vote its sharesfollowing five items of stockholder business:

a proposal to elect the three nominees for

the election of Thomas J. Finley, Jr., R. Richard Sherbahn and John J. Lyons as Class C directors we name as the nominees of our board of directors in this proxy statement to serve a term of three years and until their respective successors take office;

a proposal to amend our certificate of incorporation to increase the number of shares of our Class A common stock we have the authority to issue from 30.0 million shares to 40.0 million shares;

a proposal to approve our 2013 equity incentive plan for all of the proposals set forth in the notice of annual

meetingemployees;

a proposal to approve our 2013 equity incentive plan for directors; and for the election

a proposal to ratify our audit committee’s appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013.

What is the Company's independenteffect of our advance notice by-laws?

We have had advance notice by-laws in effect for many years as is the case with many other public accountantscompanies. Our advance notice by-laws, which comply with all applicable laws, require that a stockholder provide us with prior notice of that stockholder’s intention to nominate a candidate for 2001. Therefore, Messrs. Finley, Sherbahn and Lyons will be

electedelection as a Class C directors, the proposals set forth in the notice ofdirector at our 2013 annual meeting will be approvedof stockholders or to propose any other item of stockholder business for stockholder action at our 2013 annual meeting of stockholders.

Under our advance notice by-laws, as we summarize them each year in our proxy statements for our annual meetings of stockholders, we annually establish a date after which a stockholder may no longer propose a candidate for election as a director at that year’s annual meeting of stockholders and KPMG LLP will be elected asmay no longer propose any other item of stockholder business for consideration and a vote by our stockholders at that year’s annual meeting of stockholders. For our 2013 annual meeting of stockholders, that date was December 19, 2012. For our 2014 annual meeting of stockholders, that date is December 18, 2013. The purpose of our advance notice by-laws is to ensure that we can include in our annual proxy statements, for the Company's

independent public accountants for 2001, irrespectiveinformation of all of our stockholders, all of the votes castactions we or others propose to present for consideration by our stockholders at each of our annual meetings of stockholders.

No stockholder has nominated a candidate for election as a Class C director at our 2013 annual meeting of stockholders or proposed the transaction of any other item of stockholder business at our 2013 annual meeting of stockholders on or before the date our advance notice by-laws specify. Accordingly, no item of the Companystockholder business other than the Mutual Company.

WHO CAN ATTEND THE ANNUAL MEETING?

Allfive items of stockholder business we describe in our notice of our 2013 annual meeting of stockholders, as well as in this proxy statement, may properly come before our 2013 annual meeting of stockholders or any adjournment or postponement of our 2013 annual meeting of stockholders. As a result, we will not submit any other item of stockholder business, other than procedural matters related to the conduct of our 2013 annual meeting of stockholders, to a vote of our stockholders at our 2013 annual meeting of stockholders.

We are a Delaware corporation. Therefore, the Delaware General Corporation Law, or the DGCL, our certificate of incorporation and our by-laws govern the conduct of business at our annual meetings of stockholders, our relationships with our stockholders and the rights, powers, duties and obligations of our stockholders, directors, nominees for directors, officers and employees.

What is a quorum for the conduct of business at our 2013 annual meeting of stockholders?

Our by-laws provide that the presence, in person or by proxy, of not less than a majority of the aggregate voting power of our outstanding shares of Class A common stock and our outstanding shares of Class B common stock as of the record date for our annual meeting will constitute a quorum at our 2013 annual meeting of stockholders. Because Donegal Mutual owns approximately 66% of the aggregate voting power of our Class A common stock and our Class B common stock outstanding on the record date and because Donegal Mutual will vote all of the shares of our Class A common stock and all of the shares of our Class B common stock it owns in person at our 2013 annual meeting of stockholders, the presence in person of the Donegal Mutual shares at our 2013 annual meeting of stockholders will ensure the presence of a quorum at our 2013 annual meeting of stockholders. Because of the certainty of the presence of a quorum at our 2013 annual meeting of stockholders, our stockholders will have the legal power and authority to conduct the items of stockholder business at our 2013 annual meeting of stockholders that we describe in our notice of annual meeting of stockholders and in this proxy statement with one exception. That exception is the right of the holders of our Class A common stock to vote as a separate class on the proposed amendment to increase the number of shares of our Class A common stock we have the authority to issue. A quorum for that Class A common stock separate vote is a majority of our outstanding shares of Class A common stock present in person or their dulyby proxy at our 2013 annual meeting of stockholders.

What is the order of business at our 2013 annual meeting of stockholders?

Our by-laws and applicable provisions of the DGCL govern the organization and conduct of business at our 2013 annual meeting of stockholders. Our board of directors has designated Donald H. Nikolaus, our chairman and chief executive officer, as the presiding officer of our 2013 annual meeting of stockholders. Mr. Nikolaus will call our 2013 annual meeting of stockholders to order and will preside over the transaction of the items of stockholder business we describe in this proxy statement for our 2013 annual meeting of stockholders. No other matter may properly come before our 2013 annual meeting of stockholders. Mr. Nikolaus will determine, as the presiding officer of our 2013 annual meeting of stockholders, in his discretion, the order of the items of stockholder business our stockholders will conduct at our 2013 annual meeting of stockholders and the procedural manner in which we will conduct the business of our 2013 annual meeting of stockholders.

We have historically conducted the voting on the proposals we submit for stockholder action at our annual meetings of stockholders as the first item of business. We currently intend to follow a substantially similar procedure at our 2013 annual meeting of stockholders. After our stockholders have voted on the five items of stockholder business we describe in this proxy statement, and the judges of election our board of directors has appointed proxies,have conducted the voting on those five items of stockholder business, Mr. Nikolaus will then discuss our results of operations for 2012 compared to 2011 and our outlook for 2013. After Mr. Nikolaus completes his remarks, the judges of election will announce the results of the voting on the five items of stockholder business. Then Mr. Nikolaus, in his capacity as the presiding officer of our 2013 annual meeting of stockholders, will recognize stockholders who wish to ask pertinent questions or make comments as Mr. Nikolaus, in his discretion, deems appropriate under then prevailing circumstances.

Who may attend, and who may vote, at our 2013 annual meeting of stockholders?

Our board of directors established the close of business on March 1, 2013 as the record date for the determination of the holders of our Class A common stock and the holders of our Class B common stock who are entitled to notice of, and to vote at, our 2013 annual meeting.meeting of stockholders. We refer to those eligible stockholders as “stockholders of record” in this proxy statement. Stockholders of record, including persons whom a stockholder of record duly and validly appoints as such stockholder of record’s proxy, may attend, and vote at, our 2013 annual meeting of stockholders.

We reserve the right to request photographic identification, such as a currently valid driver’s license, before we permit a stockholder of record, or a proxy for a stockholder of record, to attend our 2013 annual meeting of

-2-

stockholders. Even if you currently plan to attend theour 2013 annual meeting of stockholders and vote in person, we recommend that you vote by proxy using one of the methods we describe in this proxy statement under “How do you vote the DGI shares registered in your name?” By voting in one of those ways, we can then recognize your votes even if you later do not, or cannot, attend our 2013 annual meeting of stockholders in person for any reason.

Our independent transfer agent, Computershare, has prepared and certified a list of all holders of our Class A common stock and all holders of our Class B common stock outstanding as of the close of business on March 1, 2013, the record date for our 2013 annual meeting of stockholders. If your name appears on that certified list of stockholders for our use in connection with our 2013 annual meeting of stockholders, you are a stockholder of record entitled to vote at our 2013 annual meeting of stockholders. For example, you are a stockholder of record if you received the proxy materials for our 2013 annual meeting of stockholders directly from us and not from another person who is the record holder of the shares you own beneficially, such as a bank, a brokerage firm or other fiduciary.

Our by-laws, in accordance with Delaware law, provide a stockholder of record an opportunity, subject to that stockholder of record’s prior compliance with certain conditions we describe in this proxy statement, during the ten calendar days preceding the date of our 2013 annual meeting of stockholders, to examine, at our principal executive offices in Marietta, Pennsylvania, an alphabetical list of the holders of record of our Class A common stock and of the holders of record of our Class B common stock. We will grant a stockholder of record’s request to make such an examination if:

the stockholder of record makes a written request to make such an examination at our principal executive offices during such 10-day period addressed to Jeffrey D. Miller, our senior vice president and chief financial officer; and

we determine, in our discretion, that the stockholder of record’s request to examine our stockholder list is proper and legally relevant to the items of stockholder business we will conduct at our 2013 annual meeting of stockholders.

If a stockholder of record does not make such a written request to inspect our list of stockholders within the specified ten-day period or if we make a discretionary determination that the stockholder of record’s request for inspection of our list of stockholders is not proper or not legally relevant to the items of stockholder business we will conduct at our 2013 annual meeting of stockholders, we will not permit that stockholder of record to examine our list of stockholders.

If you are the beneficial owner of shares of our Class A common stock or the beneficial owner of shares of our Class B common stock registered in the name of a bank, broker or other fiduciary, also known as shares held in “street name,” we consider you the beneficial owner of the shares your bank, broker or other fiduciary holds for you, and we consider your bank, your broker or your other fiduciary the stockholder of record of your shares. Your bank, your broker or your other fiduciary will send you separately, as the beneficial owner, information describing the procedure for voting your shares. You should follow the instructions your bank, your broker or your other fiduciary provides you on how to vote your shares.

What percentage of the aggregate voting power of our outstanding shares of Class A common stock and our outstanding shares of Class B common stock is necessary to approve the items of stockholder business on which our stockholders will vote at our 2013 annual meeting of stockholders?

Election of Class C Directors. The three nominees our board of directors nominated for election as Class C directors are the only nominees eligible for election as Class C directors at our 2013 annual meeting of stockholders and any adjournment or postponement of our 2013 annual meeting of stockholders. Our certificate of incorporation provides that our shares of Class A common stock and our shares of Class B common stock vote together as a single class in the election of directors. At our 2013 annual meeting of stockholders, our stockholders will elect as Class C

-3-

directors the three nominees for election as Class C directors who receive the highest number of stockholder votes. The persons elected as Class C directors will serve for a term of three years and until their respective successors take office.

If you submit your proxy as described below so that yourproperly and markWithhold Authority, the proxies will not vote will be counted if you later decide not to attend the meeting.

If you hold your shares with respect to the nominee or nominees for Class C director as to whom you have withheld authority. We will count your shares as present at our 2013 annual meeting of stockholders for the purposes of determining whether a quorum is present at our 2013 annual meeting of stockholders.

Our certificate of incorporation and our by-laws do not authorize cumulative voting in "street name" (that is, through a broker or

other nominee), you will needthe election of our directors.

Amendment to bring a copyOur Certificate of Incorporation to Authorize the Issuance of Additional Shares of Our Class A Common Stock. Approval of the amendment to our certificate of incorporation to increase the number of shares of our Class A common stock we have the authority to issue as our board of directors determines from time to time from 30.0 million shares to 40.0 million shares requires:

the affirmative vote of a brokerage statement

reflecting yourmajority of our outstanding shares of Class A common stock ownership as of the record date and check invoting as a separate class at our 2013 annual meeting of stockholders; and

the registration desk at the meeting.

WHAT CONSTITUTES A QUORUM?

The presence at the meeting, in person or by proxy, of the holdersaffirmative vote of a majority of the votes of the holders of our shares of Class A common stock outstanding onand the record date will

constitute a quorum, permitting the meeting to conduct its business. Asholders of our shares of Class B common stock as of the record date 8,875,127voting together as a single class.

Our certificate of incorporation provides that our shares of Class A common stock and our shares of Class B common stock vote together as a single class on all matters submitted to a vote of our stockholders, except that, under the Company were outstanding.

Proxies received but marked as abstentionsDGCL, our shares of Class A common stock and broker non-votes will be included

inour shares of Class B common stock each have the calculation of the number of shares considered to be present at the

meeting.

HOW DO I VOTE?

If you complete and properly sign the accompanying proxy card and return it

to the Company, it will be voted as you direct. If you are a registered

stockholder and attend the meeting, you may deliver your completed proxy card in

person. "Street name" stockholders who wishright to vote atas a separate class on any matter that would uniquely adversely affect the meeting will need to

obtain a signed proxy from the institutionrights of that holds their shares.

CAN I CHANGE MY VOTE AFTER I RETURN MY PROXY CARD?

Yes. Even after you have submitted your proxy, you may change your vote at

any time before the proxy is exercised by filing with the Secretaryclass.

Approval of the

Company either a notice of revocation or a duly executed proxy bearing a later

3

date. The powers of the proxy holders will be revoked if you attend the meeting

in person and request that your proxy be revoked, although attendance at the

meeting will not by itself revoke a previously granted proxy.

HOW DO I VOTE MY 401(K) PLAN SHARES?

If you participate in the Donegal Mutual Insurance Company 401(k) Plan, you

may vote the number of shares of common stock equivalent to the interest in

common stock credited to your account as of the record date. You may vote by

instructing Reliance Trust, the trustee of the plan, pursuant to the instruction

card being mailed with this proxy statement to plan participants. The trustee

will vote your shares in accordance with your duly executed instructions

received by April 9, 2001.

If you do not send instructions, the share equivalents credited to your

account will be voted by the trustee in the same proportion that it votes share

equivalents for which it did receive timely instructions.

You may also revoke previously given voting instructions by April 9, 2001

by filing with the trustee either a written notice or revocation or a properly

completed and signed voting instruction card bearing a later date.

WHAT ARE THE BOARD'S RECOMMENDATIONS?

Unless you give other instructions on your proxy card, the persons named as

proxy holders on the proxy card will vote in accordance with the recommendations

of the Board of Directors. The Board of Directors recommends a vote:

o for election of the nominated Class C directors (see pages 12 through

14),

o for the amendment of the Certificate of Incorporation (see pages 21

through 34),

o for the 2001our 2013 Equity Incentive Plan for Employees (see pages 35

through 39),

oEmployees. 2001 Equity Incentive Plan for Directors (see pages 40

through 44),

o for the 2001 Employee Stock Purchase Plan (see pages 44 through 48),

and

o for election of KPMG LLP as the Company's independent public

accountants for 2001 (see page 48).

WHAT VOTE IS REQUIRED TO APPROVE EACH ITEM?

Election of Directors. The affirmative vote of a plurality of the votes

cast at the meeting is required for the election of directors. A properly

executed proxy marked "WITHHOLD AUTHORITY" with respect to the election of one

4

or more directors will not be voted with respect to the director or directors

indicated, although it will be counted for purposes of determining whether there

is a quorum. Cumulative voting is not permitted in the election of directors.

Other Items. The affirmative vote of the holders of a majority of the

shares entitled to vote will be required for approval of the amendment of the

Company's Certificate of Incorporation. The affirmative vote of the holdersrecord of a majority of the voting power of our outstanding shares representedof Class A common stock and our outstanding shares of Class B common stock, voting together as a single class, present in person or by proxy and entitled to vote will be required for approvalat our 2013 annual meeting of the 2001stockholders.

Approval of our 2013 Equity Incentive Plan for Employees,Directors. Approval of our 2013 equity incentive plan for directors requires the 2001 Equity Incentive Planaffirmative vote of the holders of record of a majority of the voting power of our outstanding shares of Class A common stock and our outstanding shares of Class B common stock, voting together as a single class, present in person or by proxy and entitled to vote at our 2013 annual meeting of stockholders.

Ratification of Our Audit Committee’s Appointment of KPMG LLP. Ratification of our audit committee’s appointment of KPMG LLP as our independent registered public accounting firm for Directors,our fiscal year ending December 31, 2013 requires the 2001 Employee Stock Purchase

Planaffirmative vote of a majority of the aggregate voting power of our outstanding shares of Class A common stock and our outstanding shares of Class B common stock, voting together as a single class, present in person or by proxy and entitled to vote at our 2013 annual meeting of stockholders.

We will consider abstentions and broker non-votes as outstanding shares entitled to vote at our 2013 annual meeting of stockholders and will count those shares in determining the number of votes necessary to constitute a quorum at our 2013 annual meeting of stockholders. Under any circumstances, a quorum will be present at our 2013 annual meeting of stockholders because of the presence at our 2013 annual meeting of stockholders of the shares of our Class A common stock and the electionshares of independent public accountants. Abstentions andour Class B common stock Donegal Mutual owns.

Broker non-votes are shares

held by brokers or nominees as tohold in their name for which such broker or nominee has not received voting instructions have not been

received from the beneficial owner of, or person otherwise entitled to vote, thethose shares,

-4-

and as to which shares the broker or nominee does not have discretionary voting power, i.e.,power. Broker non-votes will not impact the presence of a quorum at our 2013 annual meeting of stockholders or affect the outcome of any matter we submit to a vote of our stockholders at our 2013 annual meeting of stockholders, except that broker non-votes are consideredwill count as votes against the proposal to amend our certificate of incorporation.

What voting rights do our stockholders have?

At March 1, 2013, we had outstanding:

20,050,649 shares of our Class A common stock, each of which entitles its holder to cast one-tenth of a vote with respect to each matter we submit for a stockholder vote at our 2013 annual meeting of stockholders; and

5,576,775 shares of our Class B common stock, each of which entitles its holder to cast one vote with respect to each matter we submit for a stockholder vote at our 2013 annual meeting of stockholders.

Therefore, the holders of record of all of our outstanding andshares of Class A common stock are entitled to cast a total of 2,005,064 votes on each matter we submit to a vote of the holders of record of our outstanding shares of our Class A common stock at our 2013 annual meeting of stockholders, and the holders of record of all of our outstanding shares of Class B common stock are counted in determiningentitled to cast a total of 5,576,775 votes on each matter we submit to a vote of the holders of record of our outstanding shares of our Class B common stock at our 2013 annual meeting of stockholders. Thus, a total of 7,581,839 votes may be cast at our 2013 annual meeting of stockholders on each item of stockholder business.

At the close of business on March 1, 2013, Donegal Mutual owned 7,755,953 shares, or 38.7%, of our outstanding Class A common stock and 4,217,039 shares, or 75.6%, of our outstanding Class B common stock. Donegal Mutual therefore has the right to cast approximately two-thirds of the total number of votes that all of our stockholders may cast at our 2013 annual meeting of stockholders on each matter we submit to a vote of our stockholders at our 2013 annual meeting of stockholders with the exception of the separate vote of the holders of our Class A common stock on the proposal to increase the number of votes necessary

for a majority. An abstention or broker non-voteshares of our Class A common stock we are authorized to issue. Because Donegal Mutual holds 38.7% of our outstanding shares of Class A common stock and the board of directors and management of Donegal Mutual and DGI own an additional 3.5% of our outstanding shares of Class A common stock, and each of them has advised us they will therefore havevote in favor of the

practical effect of voting against approval of a proposal because each

abstention and broker non-vote will represent one fewer vote for approval of the proposal.amendment to our certificate of incorporation, the votes Donegal Mutual and the members of the boards of directors of Donegal Mutual and DGI and their executive officers cast in favor of the amendment will have a substantial influence on the approval of the amendment.

Donegal Mutual has advised us that it will vote all of its shares of our Class A common stock and all of its shares of our Class B common stock as follows:

for the election of Scott A. Berlucchi, John J. Lyons and S. Trezevant Moore, Jr. as Class C directors to serve for a term of three years and until their respective successors take office;

for the approval of the amendment to our certificate of incorporation to increase the number of shares of our Class A common stock we have the authority to issue from 30.0 million shares to 40.0 million shares;

for the approval of our 2013 equity incentive plan for employees;

for the approval of our 2013 equity incentive plan for directors; and

for the ratification of our audit committee’s appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013.

Therefore, based on the votes Donegal Mutual and the officers and directors of Donegal Mutual and DGI will cast at our 2013 annual meeting of stockholders, we anticipate our stockholders will:

elect Scott A. Berlucchi, John J. Lyons and S. Trezevant Moore, Jr. as Class C directors to serve for a term of three years and until their respective successors take office;

-5-

approve the amendment to our certificate of incorporation to increase the number of shares of Class A common stock we have the authority to issue from 30.0 million shares to 40.0 million shares;

approve our 2013 equity incentive plan for employees;

approve our 2013 equity incentive plan for directors; and

ratify our audit committee’s appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013.

How do you vote your DGI shares registered in your name?

If the certified list of the holders of our Class A common stock and the holders of our Class B common stock as of the record date that our independent transfer agent prepared includes your name, you are a stockholder of record and you may attend our 2013 annual meeting of stockholders and vote in person or by proxy. The proxies our board of directors has appointed will vote your shares as you direct on any proxy card you return by mail, by telephone or over the internet. If you signprefer, you may vote your proxy by telephone or via the internet by following the instructions we include on the proxy card we sent to you along with this proxy statement and our annual report to our stockholders for 2012. The deadline for stockholders of record to vote at our 2013 annual meeting of stockholders by telephone or via the internet is 11:59 p.m., local time, on April 17, 2013. The deadline for our receipt of proxies submitted by mail or by express delivery services is 3:00 p.m., local time, on April 17, 2013.

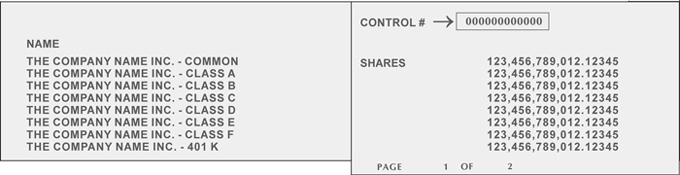

You may vote by proxy by using one of the following three methods:

Vote by telephone – use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week. Have your proxy card available when you call. When requested, enter the control numbers your proxy card lists and then follow the prompts. The telephone number is 1-800-690-6903.

Vote by mail – mark, sign and date the proxy card we have mailed to you and return it to our independent transfer agent in the postage-prepaid envelope we mailed to you along with this proxy statement and our annual report to stockholders for 2012.

Vote via the internet – use the internet to vote your proxy 24 hours a day, 7 days a week. Have your proxy card available when you access the website. When requested, enter the control numbers your proxy card lists and then create and submit your ballot over the internet. The website address for voting via the internet iswww.proxyvote.com.

If a broker, bank or broker voting instruction card with no

further instructions,other fiduciary is the holder of record of your shares, will be votedsee “How do you vote your DGI shares held in accordance withstreet name?” below.

How do you vote your DGI shares held in street name?

If you are not a stockholder of record, but you are a “beneficial owner” of our Class A common stock or our Class B common stock at the recommendationclose of business on March 1, 2013, which means that the list of our stockholders of record at the close of business on March 1, 2013 that our independent transfer agent prepared does not include your name but instead the name of the Board, i.e.,bank, broker or other fiduciary who is the holder of record of your shares, you must either direct the holder of record of your shares to vote your shares on the matters our stockholders will consider and vote upon at our 2013 annual meeting of stockholders or you must obtain a form of proxy from your holder of record that you may then vote as if you were the holder of record. Your broker does not have the discretion to vote your shares on non-routine matters, which includes the election of our Class C directors.

-6-

How does our board of directors recommend our stockholders vote at our 2013 annual meeting of stockholders?

Our board of directors unanimously recommends that each of our stockholders vote as follows:

| • | FOR the election of the three candidates for Class C directors our board of directors has nominated and we name in this proxy statement; |

| • | FORthe approval of the amendment to our certificate of incorporation to increase the number of shares of Class A common stock we have the authority to issue from 30.0 million shares to 40.0 million shares; |

| • | FORthe approval of our 2013 equity incentive plan for employees; |

| • | FOR the approval of our 2013 equity incentive plan for directors; and |

| • | FOR the ratification of our audit committee’s appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013. |

Unless you mark your proxy card to the contrary, the proxies our board of directors has appointed will vote your shares for the election of the Company'sthree nominees for Class C director,directors we name in this proxy statement, for the proposals set forth inapproval of the noticeamendment to our certificate of annual

meetingincorporation to increase the number of shares of our Class A common stock we have the authority to issue from 30.0 million shares to 40.0 million shares, for the approval of our 2013 equity incentive plan for employees, for the approval of our 2013 equity incentive plan for directors and for the electionratification of our audit committee’s appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013.

May you change your vote after you have voted by proxy but before our 2013 annual meeting of stockholders convenes?

You may revoke your proxy at any time prior to the Company's independent public

accountants.

WHO WILL PAY THE COSTS OF SOLICITING PROXIES ON BEHALF OF THE BOARD OF

DIRECTORS?

The Companytime when the proxies our board of directors appointed vote your shares during our 2013 annual meeting of stockholders. If you are a stockholder of record, you may revoke your proxy by timely:

submitting a written notice of revocation to our chief financial officer;

returning a second proxy dated later than the date of your first proxy by telephone, via the internet or by mail; or

voting in person at our 2013 annual meeting of stockholders.

However, if you attend our 2013 annual meeting of stockholders in person and do not submit a ballot, our proxies will vote the proxy you most recently submitted to them in accordance with the instructions you provided on that most recent proxy.

If a bank, broker, nominee, other fiduciary or other person is making this solicitation and will pay the costholder of soliciting

proxies on behalfrecord of the Boardshares you own, you will need to follow the instructions of Directors, including expensesthe bank, broker, nominee, other fiduciary or other holder of preparingrecord as to how you may revoke your proxy.

If you have any questions about our 2013 annual meeting of stockholders or voting your shares, please call Jeffrey D. Miller, our senior vice president and mailing this proxy statement. In addition to mailing these proxy materials, the

solicitationchief financial officer, at 1-800-877-0600 or e-mail Mr. Miller atjeffmiller@donegalgroup.com.

-7-

The Ownership of proxies or votes may be made in person or by telephone or

telegram by the Company's regular officers and employees, none of whom will

receive special compensation for such services. Upon request, the Company will

also reimburse brokers, nominees, fiduciaries and custodians and persons holding

shares in their names or in the names of nominees for their reasonable expenses

in sending proxies and proxy material to beneficial owners.

STOCK OWNERSHIP

WHO ARE THE LARGEST OWNERS OF THE COMPANY'S STOCK?

Our Principal Stockholders

The following table identifiesbelow lists each person who is known by the Company towhom we believe beneficially ownowned 5% or more than 5% of the Company's outstanding shares of our Class A common stock. All

information isstock or 5% or more of the outstanding shares of our Class B common stock as of February 21, 2001 unless otherwise noted.

5

SHARES PERCENT OF

NAME OF INDIVIDUAL BENEFICIALLY OUTSTANDING

OR IDENTITY OF GROUP OWNED COMMON STOCK

-------------------- ----- ------------

Donegal Mutual Insurance Company 5,511,127 62.2%

1195 River Road

Marietta, PA 17547

Wellington Management Company, LLP 498,400(1) 5.6%

75 State Street

Boston, MA 02109

- ------------------

(1) As reported by Wellington Management Company, LLP asthe close of December 31, 2000

in a filing madebusiness on March 1, 2013.

Name of Individual or Identity of Group | Class A Shares Beneficially Owned | Percent of Class A Common Stock | Class B Shares Beneficially Owned | Percent of Class B Common Stock | ||||||||||||

Donegal Mutual Insurance Company 1195 River Road Marietta, PA 17547 | 7,755,953 | 38.7 | % | 4,217,039 | 75.6 | % | ||||||||||

Gregory M. Shepard(1) 7028 Portmarnock Place Bradenton, FL 34202 | 3,602,900 | 18.0 | 397,100 | 7.1 | ||||||||||||

Dimensional Fund Advisors LP(2) 1299 Ocean Avenue Santa Monica, CA 90401 | 1,413,877 | 7.1 | — | — | ||||||||||||

| (1) | Mr. Shepard reported the ownership information shown in the above table in a Schedule 13D/A he filed with the Securities and Exchange Commission, or the SEC, on November 6, 2012. |

| (2) | Dimensional Fund Advisors LP reported the ownership information shown in the above table in a Schedule 13G/A it filed with the SEC on February 11, 2013. Dimensional Fund Advisors LP disclaims beneficial ownership of these shares. |

-8-

The Ownership of Our Directors and Exchange Commission (the "SEC").

HOW MUCH STOCK DO THE COMPANY'S DIRECTORS AND EXECUTIVE OFFICERS OWN?

Executive Officers

The following table shows the amount and percentage of the Company's

outstanding shares of our Class A common stock beneficially owned byand outstanding shares of our Class B common stock that each directorof our directors and nomineeeach of our nominees for director, each executive officerof our named in the Summary Compensation Table and all executive officers and directorsall of the Companyour executive officers, our nominees for director and directors as a group asowned beneficially at the close of February 21,

2001.

SHARES PERCENT OF

NAME OF INDIVIDUAL BENEFICIALLY OUTSTANDING

OR IDENTITY OF GROUP OWNED(1) COMMON STOCK(2)

-------------------- -------- --------------

DIRECTORS AND NOMINEES:

C. Edwin Ireland 20,440(3) --

Donald H. Nikolaus 486,892(4) 5.3%

Patricia A. Gilmartin 11,905(3) --

Philip H. Glatfelter, II 14,379(3) --

R. Richard Sherbahn 10,026(3) --

Robert S. Bolinger 11,481(3) --

Thomas J. Finley, Jr. 10,574(3) --

John J. Lyons -0- --

6

EXECUTIVE OFFICERS (5):

Ralph G. Spontak 173,760(6) 1.9%

William H. Shupert 67,944(7) --

Robert G. Shenk 70,071(8) --

James B. Price 61,748(9) --

All directors and executive officers

as a group (12 persons) 983,947(10) 10.3%

- --------------

(1) Information furnished bybusiness on March 1, 2013. The total shown for each individual named. This tableperson includes shares that arethe person owned jointly, in whole or in part, with the person'sperson’s spouse, or owned individually by histhe person’s spouse and shares purchasable upon the exercise of stock options that were exercisable as of March 1, 2013 or her spouse.

(2) Lessbecome exercisable within 60 days of March 1, 2013. Ownership is less than 1% unless otherwise indicated. (3) Includes 8,889The business address of each of our executive officers, directors and nominees for director is c/o Donegal Group Inc., 1195 River Road, P.O. Box 302, Marietta, Pennsylvania 17547.

Name of Individual or Identity of Group | Class A Shares Beneficially Owned(2) | Percentage of Class A Common Stock(2) | Class B Shares Beneficially Owned | Percentage of Class B Common Stock | ||||||||||||

Directors and Nominees for Director: | ||||||||||||||||

Donald H. Nikolaus(1) | 943,307 | 4.6 | % | 186,375 | 3.3 | % | ||||||||||

Scott A. Berlucchi | 27,855 | — | — | — | ||||||||||||

Robert S. Bolinger | 32,310 | — | 1,450 | — | ||||||||||||

Patricia A. Gilmartin | 31,929 | — | — | — | ||||||||||||

Philip H. Glatfelter, II | 36,835 | — | 3,276 | — | ||||||||||||

Jack L. Hess | 30,533 | — | — | — | ||||||||||||

Kevin M. Kraft, Sr. | 31,036 | — | — | — | ||||||||||||

John J. Lyons | 70,706 | — | 1,776 | — | ||||||||||||

Jon M. Mahan | 29,188 | — | — | — | ||||||||||||

S. Trezevant Moore, Jr. | 27,855 | — | 1,000 | — | ||||||||||||

R. Richard Sherbahn | 32,205 | — | 677 | — | ||||||||||||

Richard D. Wampler, II | 30,078 | — | — | — | ||||||||||||

Executive Officers: | ||||||||||||||||

Kevin G. Burke | 140,000 | — | — | — | ||||||||||||

Cyril J. Greenya | 145,017 | — | 820 | — | ||||||||||||

Jeffrey D. Miller | 166,722 | — | 582 | — | ||||||||||||

Robert G. Shenk | 158,195 | — | — | — | ||||||||||||

Daniel J. Wagner | 172,326 | — | 166 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

All directors and executive officers as a group (17 persons) | 2,106,097 | 9.8 | % | 196,122 | 3.5 | % | ||||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | Includes 166,369 shares of our Class A common stock and 3,938 shares of our Class B common stock owned at March 1, 2013 by a family foundation of which Mr. Nikolaus is trustee. |

| (2) | Includes currently exercisable stock options to purchase 25,000 shares of Class A common stock that each director we list above beneficially owns, other than Mr. Hess, who holds exercisable stock options to purchase 18,000 shares of Class A common stock, and Mr. Nikolaus. Also includes, with respect to each executive officer, the following currently exercisable stock options to purchase shares of Class A common stock the executive officer beneficially owns: Mr. Nikolaus, 483,333 shares; Mr. Burke, 140,000 shares; Mr. Greenya, 140,000 shares; Mr. Miller, 150,000 shares; Mr. Shenk, 140,000 shares and Mr. Wagner 140,000 shares. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires that each of our executive officers, each of our directors and each holder of 10% or more of our Class A common stock the director has the option to

purchase under the Company's Amended and Restated 1996 Equity Incentive

Plan for Directors (the "1996 Director Plan") that are currently

exercisable or that become exercisable within 60 days after the date10% or more of this Proxy Statement.

(4) Includes 300,000 shares ofour Class B common stock Mr. Nikolaus has the option to

purchase under the Company's 1996 Amended and Restated Equity Incentive

Plan (the "1996 Equity Incentive Plan") that are currently exercisable or

that become exercisable within 60 days after the datereport such person’s ownership of this Proxy

Statement.

(5) Excludes executive officers listed under "Directors."

(6) Includes 139,999 shares ofour Class A common stock Mr. Spontak has the option to

purchase under the 1996 Equity Incentive Plan that are currently

exercisable or that become exercisable within 60 days after the date of

this Proxy Statement.

(7) Includes 60,666 shares ofand our Class B common stock Mr. Shupert hasto the option to

purchase under the 1996 Equity Incentive Plan that are currently

exercisable or that become exercisable within 60 days after the date of

this Proxy Statement.

(8) Includes 61,667 shares of common stock Mr. Shenk has the option to purchase

under the 1996 Equity Incentive Plan that are currently exercisable or that

become exercisable within 60 days after the date of this Proxy Statement.

(9) Includes 53,333 shares of common stock Mr. Price has the option to purchase

under the 1996 Equity Incentive Plan that are currently exercisable or that

become exercisable within 60 days after the date of this Proxy Statement.

7

(10) Includes 650,108 shares of common stock purchasable upon the exercise of

options granted under the 1996 Equity Incentive Plan that are currently

exercisable or that become exercisable within 60 days after the date of

this Proxy Statement, and 53,334 shares of common stock purchasable upon

the exercise of options granted under the 1996 Director Plan that are

currently exercisable or that become exercisable within 60 days after the

date of this Proxy Statement.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16 of the Securities Exchange Act of 1934 (the "Exchange Act")

requires that the officers and directors of the Company, as well asSEC. Such persons who

own more than 10% of a class of equity securities of the Company,

-9-

also must file reports

of their ownership of the Company's securities, as well as monthly statements of changes in such ownership with the Company, the SEC within two days of a change in such person’s ownership of our Class A common stock or our Class B common stock. Our executive officers and the Nasdaq Stock

Market. Based upon written representations received by the Company from its

officers, directors, our nominees for election as director, certain holders of 10% or more of our Class A common stock and certain holders of 10% or more than 10% stockholders, and the Company's review of the monthly statementsour Class B common stock have advised us in writing that each of ownership changes filed with the Company by its

officers, directors and more than 10% stockholders during 2000, the Company

believes thatthem made all suchrequired filings required during 2000 were made on a timely basis.basis during 2012.

THE RELATIONSHIP WITH THEOF DONEGAL MUTUAL COMPANY

The Company wasAND DGI

A group of local residents and business owners in Lancaster County, Pennsylvania formed by theDonegal Mutual Company in August 19861889 to provide property and was a

wholly owned subsidiarycasualty insurance. Now, 124 years later, Donegal Mutual has succeeded and grown to have approximately $350.7 million in total assets and surplus of approximately $187.7 million at December 31, 2012. In addition, Donegal Mutual owns 38.7% of the Mutual Company until November 1986, when the

Company sold 600,000outstanding shares of our Class A common stock and 75.6% of the outstanding shares of our Class B common stock.

DGI, at December 31, 2012, had total assets of approximately $1.3 billion and stockholders’ equity of approximately $400.0 million. Donegal Mutual and DGI’s insurance subsidiaries conduct business together as the Donegal Insurance Group in 22 Mid-Atlantic, Midwestern, New England and Southern states.

During 2012, A.M. Best Company reported that the Donegal Insurance Group ranked as the 101st largest property and casualty insurance group in the United States based on its 2011 net premiums written. A.M. Best Company has assigned the Donegal Insurance Group an A.M. Best rating of A (Excellent) for the past 19 consecutive years.

Since we established Atlantic States in 1986, Donegal Mutual and our insurance subsidiaries have conducted business together as the Donegal Insurance Group, while retaining their separate legal and corporate existences. As such, Donegal Mutual and our insurance subsidiaries share the same business philosophies, the same management, the same employees and the same facilities and offer the same types of insurance products. We believe Donegal Mutual’s majority interest in the combined voting power of our Class A common stock and of our Class B common stock in us fosters our ability to implement our business philosophies, enjoy management continuity, maintain superior employee relations and provide a stable environment within which we can grow our businesses.

In addition, as the Donegal Insurance Group, Donegal Mutual and our insurance subsidiaries share a combined business plan to enhance market penetration and underwriting profitability objectives. The products Donegal Mutual and our insurance subsidiaries offer are generally complementary, which permits the Donegal Insurance Group to offer a broad range of products in a given market and to expand the Donegal Insurance Group’s ability to service an entire personal lines or commercial lines account. Distinctions within the products Donegal Mutual and our insurance subsidiaries offer generally relate to specific risk profiles within similar classes of business, such as preferred tier products versus standard tier products. Donegal Mutual and we do not allocate all of the standard risk gradients to one company. As a result, the underwriting profitability of the business the individual companies write directly will vary. However, since the underwriting pool homogenizes the risk characteristics of all business Donegal Mutual and Atlantic States write directly, Donegal Mutual and Atlantic States share the underwriting results in proportion to their respective participation in the underwriting pool. We receive 80% of the results of the underwriting pool because Atlantic States has an 80% participation in the pool. The business Atlantic States derives from the pool represents a significant percentage of our total consolidated revenues. However, that percentage has gradually decreased over the past few years as we have acquired a number of other companies in other jurisdictions that do not participate in the underwriting pool.

From time to time, the board of directors of Donegal Mutual and our board of directors review our structure and relationships. The most recent such review occurred in November and December 2012. As a result of these

-10-

reviews, both our board of directors and Donegal Mutual’s board of directors continue to believe, as of the date of this proxy statement, that the Donegal Mutual-DGI structure continues to be appropriate for the respective businesses and operations of DGI and of Donegal Mutual.

In the mid-1980s, Donegal Mutual recognized the desirability, as a mutual insurance company, of developing additional sources of capital and surplus so it could remain competitive and have the surplus to expand its business and ensure its long-term viability. Donegal Mutual determined to implement a downstream holding company structure as one of its business strategies. Accordingly, in 1986, Donegal Mutual formed us as a downstream holding company. Initially, Donegal Mutual owned all of our outstanding common stock. We in turn formed Atlantic States as our wholly owned property and casualty insurance company subsidiary. We subsequently effected a public offering thereby

reducingin September 1986 to provide the surplus necessary to support the business Atlantic States began to receive on October 1, 1986 as its share under a proportional reinsurance agreement, or the pooling agreement, between Donegal Mutual Company's ownershipand Atlantic States that became effective on that date.

Under the pooling agreement, Donegal Mutual and Atlantic States pool substantially all of their respective premiums, losses and loss expenses. Donegal Mutual then cedes 80% of the Company's outstanding common

stock from 100%pooled business to approximately 79.5%, which subsequently increasedAtlantic States. Our insurance subsidiaries pay dividends to approximately 84%. In September 1993,us annually. During the Company sold 1,150,000 sharesyear ended December 31, 2012, our insurance subsidiaries paid a total of common stock$7.0 million in dividends to us. These dividends are a public offering. At the same time, the Mutual Company sold

200,000 sharesmajor source of the Company's common stock, reducingfunds we utilize to pay quarterly cash dividends to our stockholders. Donegal Mutual received $5.6 million in dividends from us during the Mutual Company's

ownershipyear ended December 31, 2012.

As the capital of Atlantic States and our other insurance subsidiaries has increased, the Company's outstanding common stock to approximately 57%. From

that date through February 21, 2001, the Mutual Company has at various times

purchased an aggregateunderwriting capacity of 591,100 shares of the Company's common stock in the

open market in exempt transactions under SEC Rule 10b-18 and in private

transactions. In addition, since the adoption of the Company's Dividend

Reinvestment Plan in July 1997, the Mutual Company has purchased 555,905 shares

of the Company's common stock through the reinvestment of dividends. The Mutual

Company owned 5,511,127 shares, or approximately 62.2% of the Company's common

stock, as of February 21, 2001.

The Company's operations are interrelated with the operations of the Mutual

Company, and various reinsurance arrangements exist between the Company and the

Mutual Company. The Company believes that its various transactions with the

Mutual Company have been on terms no less favorable to the Company than the

terms that could have been negotiated with an independent third party.

8

The Mutual Company provides all personnel for the Company and certain of

itsour insurance subsidiaries, including Atlantic States, has proportionately increased. The size of the underwriting pool has increased substantially. Therefore, as we originally planned in the mid-1980s, Atlantic States has successfully raised the capital necessary to support the growth of its direct business as well as to accept increases in its allocation of business from the underwriting pool. Atlantic States’ allocation of the pooled business has increased from an initial allocation of 35% in 1986 to an 80% allocation since March 1, 2008. We do not anticipate any further change in the pooling agreement between Atlantic States and Donegal Mutual in the foreseeable future, including any change in the percentage participation of Atlantic States in the underwriting pool.

We recapitalized in April 2001. We effected a one-for-three reverse stock split of our common stock and renamed it Class B common stock and issued two shares of our Class A common stock as a stock dividend for each post-reverse stock split share of our Class B common stock. Our Class A common stock has one-tenth of a vote per share and our Class B common stock has one vote per share. As a result of the reverse split and the stock dividend, each of our stockholders at April 19, 2001 continued to own the same number of shares of our common stock, with one-third of the shares being shares of our Class B common stock and two-thirds of the shares being shares of our Class A common stock. As a result, the relative voting power and equity interest of our stockholders at the time of our recapitalization remained constant. Donegal Mutual’s continued ownership of more than a majority of the voting power of our outstanding common stock better enables us to maintain our long-term relationship with Donegal Mutual, which our board of directors believes is a central part of our business strategy and success.

We effected our recapitalization because we believed in 2001, and continue to believe as of the date of this proxy statement, that a capital structure that has more than one class of publicly traded securities offers us a number of benefits. The principal benefit from our recapitalization is our ability to issue our Class A common stock or securities convertible into or exchangeable for our Class A common stock for financing, acquisition and compensation purposes without materially adversely affecting the relative voting power of any of our stockholders, including Donegal Mutual. At the time of our recapitalization, our board of directors recognized that our recapitalization was likely to favor longer-term investors, including Donegal Mutual, and could

-11-

discourage attempts to acquire us, which our board of directors believed to be remote in any event because Donegal Mutual has owned more than a majority of the voting power of our common stock since our formation in 1986.

Every holder of our Class A common stock and our Class B common stock who has purchased our Class A common stock or our Class B common stock has purchased our Class A common stock or our Class B common stock with the prior knowledge and consistent disclosure by us that Donegal Mutual has, since our formation in 1986, held greater-than-majority voting control of us for the reasons we discuss in this proxy statement, and that Donegal Mutual currently intends to retain that greater-than-majority voting control for the long-term future because it believes that greater-than-majority voting control is in our long-term best interests and the long-term best interests of Donegal Mutual.

Our board of directors remains of the opinion that preservation of the relationship between Donegal Mutual and us and our status as an independent public company is in the best interests of all of the constituencies that we and Donegal Mutual serve, including our stockholders, the policyholders of our insurance subsidiaries, the policyholders of Donegal Mutual, Donegal Mutual’s employees, the independent insurance agents who represent our insurance companies and the local communities in which we maintain offices. We believe our relationship with Donegal Mutual offers us and our insurance subsidiaries a number of competitive advantages, including the following:

facilitating the stable management, consistent underwriting discipline, external growth and long-term profitability of the Donegal Insurance Group;

creating operational and expense synergies given the combined resources and operating efficiencies of the Donegal Insurance Group;

enhancing our opportunities to expand by acquisition because of the ability of Donegal Mutual to acquire control of other mutual insurance companies and thereafter demutualize them and sell them to us at a fair price;

producing more uniform and stable underwriting results for the Donegal Insurance Group than any of the individual member companies could achieve without the relationship between Donegal Mutual and our insurance subsidiaries; and

providing Donegal Mutual and Atlantic States with a significantly larger underwriting capacity because of the underwriting pool Donegal Mutual and Atlantic States have maintained since 1986 than either company could have achieved independently.

Our board of directors reviewed our relationships with Donegal Mutual in the fourth quarter of 2012 and the first two months of 2013 and determined that the continuation of the existing relationships between Donegal Mutual and us are in our best interests and in the best interests of our stockholders. In the latter portion of the fourth quarter of 2012 and the first quarter of 2013, the board of directors of Donegal Mutual undertook its annual review of the transactions between Donegal Mutual and DGI and determined that continuing the current transactions between Donegal Mutual and DGI and the current corporate structure of Donegal Mutual and DGI is in the best interests of Donegal Mutual and in the best interests of its various constituencies.

We refer to our Form 10-K Annual Report for the fiscal year ended December 31, 2012 for a discussion of our business strategy.

Our Strategy to Maximize Stockholder Value

A fundamental goal of our board of directors and management is to maximize stockholder value over the long-term. We conduct our operations with this fundamental goal in mind. Our business strategies seek to maximize stockholder value by improving operating efficiencies as well as pursuing internal and external growth in order to

-12-

enhance the long-term profitability of our businesses. Our board of directors and management regularly evaluate our business strategies and concentrate on improving our long-term, sustainable earnings. We focus on:

generating sustainable underwriting profitability by carefully selecting product lines, evaluating individual risks based on historic results, minimizing individual exposure to catastrophe-prone areas, analyzing the cost and availability of reinsurance as well as the level at which the reinsurance attaches and evaluating claims history on a regular basis to ensure the adequacy of underwriting guidelines and product pricing;

pursuing profitable growth by organic expansion within the traditional operating territories of our insurance subsidiaries through developing and maintaining quality agency representation;

seeking to acquire property and casualty insurance companies that augment the organic growth of our insurance subsidiaries in existing markets and expand our business into new geographic regions;

enhancing the profitability of our insurance subsidiaries through expense controls and the utilization of state-of-the-art technology to increase operating efficiency and effective communication with agents, policyholders and potential policyholders;

providing responsive and friendly customer and agent service to enable our insurance subsidiaries to attract new policyholders and retain existing policyholders; and

maintaining premium rate adequacy to enhance the underwriting results of our insurance subsidiaries, while maintaining high levels of retention for their existing books of business, and at the same time preserving their ability to write new business.